Charles C. Shulman, Esq.

EBEC Law Update

January 30, 2009

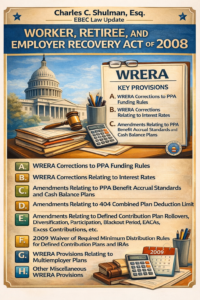

Worker, Retiree, and Employer Recovery Act of 2008

A. WRERA Corrections to PPA Funding Rules

B. WRERA Corrections Relating to Interest Rates

C. Amendments Relating to PPA Benefit Accrual Standards and Cash Balance Plans

D. Amendments Relating to 404 Combined Plan Deduction Limit

E. Amendments Relating to Defined Contribution Plan Rollovers, Diversification, Participation, Blackout Period, EACAs, Excess Contributions, etc.

F. 2009 Waiver of Required Minimum Distribution Rules for Defined Contribution Plans and IRAs

G. WRERA Provisions Relating to Multiemployer Plans

H. Other Miscellaneous WRERA Provisions

The Worker, Retiree, and Employer Recovery Act of 2008, P.L. 110-458, H.R. 7327, enacted Dec. 10, 2008 (“WRERA”), makes technical corrections to the Pension Protection Act of 2006 (“PPA”), provides temporary pension funding relief for defined benefit plans, suspends minimum distribution requirements for defined contribution plans and IRAs for 2009, and makes other pension related changes.

A. WRERA Corrections to PPA Funding Rules.

1. Technical Corrections Relating to PPA Minimum Funding Requirements.

(a) Prohibition on Increases in Benefits While Funding Waiver in Effect. Code § 412(c)(7)(A) prohibits an increase in benefits while minimum funding waivers are in effect or if certain retroactive amendments (as defined in § 412(d)(2)) were made in the past 12 months. WRERA provides that the restriction for retroactive amendments is limited to retroactive amendments that reduce accrued benefits. Code § 412(c)(7)(A); WRERA § 101(a).

(b) Determination of Target Normal Cost. WRERA clarifies that a plan’s target normal cost is increased under Code §§ 430(b) & (i) by the amount of plan-related expenses to be paid from the plan and decreased by the amount of mandatory employee contributions expected to be made to the plan in the plan year. WRERA § 101(b). This is effective for plan years beginning in 2009 and elective before then.

(c) Transition Rule for Quarterly Contribution Requirement. With regard to accelerated quarterly contributions required by PPA under Code § 430(j)(3) if a plan has a funding shortfall, a transition rule for the plan year beginning in 2008 is provided by WRERA § 101(b).

(d) Effective Date. The WRERA technical corrections are generally effective as if included in PPA (which is generally for plan years beginning in 2008). WRERA § 112.

2. Adjustment to PPA Funding Transition Rule. Under PPA’s minimum funding rules, which become effective for plan years beginning in 2008, the “funding shortfall” (excess of “funding target” over plan assets, with funding target meaning present value of benefit liabilities accrued to date) must be amortized over 7 years. Code § 430(c). The minimum contribution for plans with a funding shortfall is the sum of (i) target normal cost (present value of benefit expected to accrue in plan year), plus (ii) the shortfall amortization charge for that year. Code § 430(a). PPA provides a transition rule that plans with funding targets of at least 92% of assets in 2008, 94% in 2009 or 96% in 2010 need only fund to that level, provided that the shortfall for the preceding years after 2007 was zero, i.e., that the plan met the special rule for such prior years. Code § 430(c)(5). WRERA amends Code § 430(c)(5) to delete the requirement that shortfalls of preceding years after 2007 be zero, and applies the transition rule for 2008-2010 regardless of the shortfall for the prior year(s). WRERA § 202 deleting Code § 430(c)(5)(iii).

3. Amendments Related to Minimum Funding Rules and Valuation of Plan Assets. For a single-employer defined benefit plan, PPA provided new rules for determining minimum funding requirements. In general, the required minimum funding depends on the value of the plan’s assets relative to the plan’s funding target and target normal cost. Code § 430(a). Under PPA minimum funding rules, the value of plan assets may be determined on the basis of the averaging of fair market values, but only if such method: (1) is permitted under regulations; (2) does not provide for averaging of fair market values over more than the two year period preceding the plan’s valuation date; and (3) does not result in a determination of the value of plan assets that at any time is less than 90% or more than 110% of the fair market value of the assets at that time. Proposed regulations, 72 F.R. 74215 (December 31, 2007), provide pursuant to § 430(g)(3) (which directs Treasury to issue rules) that the average value of plan assets generally is increased/decreased for contributions/distributions that are included in the last valuation date during the averaging period but that were not included in the prior valuation dates. WRERA provides that averaging of a plan’s assets will be adjusted for expected earnings as specified by the Treasury. Such an adjustment is in addition to existing law adjustments for contributions and distributions. Expected earnings are to be determined by a plan’s actuary on the basis of an assumed earnings rate for the plan as specified by the actuary. The assumed earnings rate cannot exceed the applicable third segment rate. Code § 430(g)(3); WRERA § 121.

4. One Year Additional Relief From § 436(e) Restriction on Benefit Accruals With Severe Funding Shortfall. Under PPA, for plan years beginning after 2007 Code § 436(e) provides that if the adjusted funding target attainment percentage (ratio of assets to funding target) falls below 60%, all future benefit accruals must cease. WRERA § 203 provides that for plan years beginning in the period of October 1, 2008 through September 30, 2009, the benefit accrual limit can be applied using the plan’s funding for the preceding plan year instead of the current year.

5. Technical Corrections Relating to PPA Benefit Limitations – Accelerated Payment Restrictions for Underfunded Plans Under § 436 Do Not Apply to Small Sum Cashouts. PPA provides that certain underfunded plans may not make accelerated payments, e.g., lump sum payments. Code § 436(d)(5). WRERA provides in Code § 436(d)(5) that small-sum cashouts of $5,000 or less under Code § 411(a)(11) are not subject to the above limitation on accelerated payments. WRERA § 101(c). See above that WRERA technical corrections generally effective as if included in PPA.

6. Defined Benefit Plan Funding Notice and Disclosure of Withdrawal Liability. Under PPA, the administrator of single-employer or multiemployer defined benefit plans must provide an annual plan funding notice under ERISA § 101(f). WRERA conforms the measurement dates of several items required to be in the notice, and it also conforms the assets and liability information of a multiemployer plan’s notice to be the same as the asset and liability information of a single employer plan’s notice. ERISA § 101(f)(2)(B)(ii); WRERA § 105(a).

B. WRERA Corrections Relating to Interest Rates.

1. Extension of Replacement of 30-Year Treasury Rates Under PFEA and PPA. The Pension Funding Equity Act of 2004 provided for a temporary interest rate (used for funding purposes), and also provided that, if certain requirements are satisfied, plan amendments to reflect such interest rate need not be made before the end of the plan year beginning in 2006. PPA extended the temporary interest rate through plan years beginning in 2007 and also extended the required amendment date to the end of the plan year beginning in 2008. WRERA further extends temporary interest rate to plan years beginning in 2009, with the required amendment date by the end of the first plan year beginning in 2009. WRERA § 103(a).

2. Interest Rate Assumption for Determining Lump Sum Distributions for 415 Purposes. PPA amended the interest and mortality table used in calculating the minimum value of lump sums. WRERA clarifies in Code § 415(b)(2)(E) that the mortality table used in calculating the minimum value of lump sums is also used in adjusting Code § 415 defined benefit limits. This clarification is effective for years beginning in 2009, and is elective before then. WRERA § 103(b).

3. Modification of § 415(b) Interest Rate Assumptions for Certain Small Employer Plans. Under Code § 415(b)(1), annual benefits may not exceed the lesser of (i) 100% of average compensation or (ii) $160,000 as adjusted ($195,000 in 2009). If the benefit is not a straight annuity it is measured as the actuarial equivalent of the straight life annuity. Code § 415(b)(2)(B). For lump sum benefits (i.e., benefit forms subject to § 417(e)) the interest rate must be not less than the greater of (i) 5.5%, (ii) 105% of rate used for small sums under § 417(e), or (iii) the interest rate specified in the plan. Code § 410(b)(2)(E). WRERA provides that for a plan maintained by a small employer under Code § 408(p)(2)(C)(i) (not more than 100 employees for the preceding year), the interest rate for § 415(b) may not be less than the greater of (i) 5.5% or the interest rate specified in the plan. Code § 410(b)(2)(E)(vi) added by WRERA § 122. It is effective for years beginning after 2008.

C. Amendments Relating to PPA Benefit Accrual Standards and Cash Balance Plans.

1. Preservation of Capital. PPA prohibits applicable defined benefit plans (such as cash balance plans) from being reduced below the aggregate amount of contributions. Under WRERA, failure to comply with this rule is treated as a violation of the age discrimination rules under ERISA or the Code, as applicable. Code § 411(b)(5)(B)(i)(II); ERISA § 204(b)(5)(B)(i)(II); WRERA § 107(a)(3) & (b)(3).

2. Application of Present-Value Rules. PPA permits a cash balance plan to distribute an amount equal to the participant’s hypothetical account balance under the plan without violating the present-value rules of Code § 417(e). Code § 411(a)(13). Code § 411(a)(11) allows automatic cash-outs of amounts not exceeding $5,000. WRERA adds cross-references to apply the § 417(e) present value rules new provisions for purposes of § 411(a)(11). Code § 411(a)(13); WRERA § 107(a)(1) & (b)(2).

3. Effective Date. The general effective date under PPA § 701(e)(1) is periods beginning on or after June 29, 2005, and special effective dates are provided for certain provisions. WRERA provides that the 3 year vesting provisions for cash balance plans are effective for plan years ending on or after June 29, 2005 with respect to participants with an hour of service after the applicable effective date. Code § 411(a)(13)(B). WRERA 107(c).

D. Amendments Relating to 404 Combined Plan Deduction Limit.

1. § 404(a)(7) Deduction Limitations – Funding Component of Combined Limit. Under Code § 404(a)(7)(A), if defined benefit plan(s) and defined contribution plan(s) cover at least one of the same employees, the overall deduction limit is generally the greater of (1) 25% of compensation or (2) the amount necessary to meet the minimum funding requirement of the defined benefit plan for the plan year. Under PPA the combined plan limit is not less than the plan’s funding shortfall as determined under the funding rules. Code § 404(a)(7)(A). Under WRERA the combined plan limit is not less than the excess (if any) of the plan’s funding target over the value of the plan’s assets. Code § 404(a)(7)(A); WRERA § 108(a)(2).

2. 6% Threshold for Defined Contribution Plans Under 404(a)(7). With regard to the above combined limit, PPA provides that the overall deduction limit of Code § 404(a)(7) applies to contributions to one or more defined contribution plans only to the extent that such contributions exceed 6% of compensation. Code § 404(a)(7)(C). The IRS in Notice 2007-28 takes the position that if defined contributions are less than 6% of compensation, contributions to the defined contribution and defined benefit plans are still be subject to limitation of the greater of 25% of compensation or the minimum required contribution. WRERA provides that if defined contributions are less than 6% of compensation, the defined benefit plan is not subject to the overall deduction limit. If defined contributions exceed 6% of compensation, only defined contributions in excess of 6% are counted toward the overall deduction limit. Code § 404(a)(7)(C); WRERA § 108(c).

E. Amendments Relating to Defined Contribution Plan Rollovers, Diversification, Participation, Blackout Period, EACAs, Excess Contributions, etc.

1. Direct Rollovers From Retirement Plans to Roth 401(k) Accounts Permitted. PPA permits a distribution from a tax-qualified plan, 403(b) plan, or 457 plan to be rolled over directly into a Roth IRA, subject to certain conditions, including recognition of the distribution in gross income and phase-out of the ability to perform such a rollover based on the distributee’s adjusted gross income. Code § 408A(c)(3)(B). WRERA provides that a rollover from a Roth designated account in a tax-qualified plan, or 403(b) plan, to a Roth IRA is not subject to the gross income inclusion and adjusted gross income conditions. Code § 408A(c)(3)(B) & (d)(3)(B); WRERA § 108(d).

2. Rollovers by Nonspouse Beneficiaries of Certain Retirement Plan Distributions Permitted. PPA permits rollovers of qualified plan benefits of nonspouse beneficiaries. Code § 402(c)(11). WRERA clarifies that the current treatment with respect to a trustee-to-trustee transfer from an inherited IRA to another inherited IRA continues to apply. WRERA also provides that, effective for plan years beginning in 2010, rollovers by nonspouse beneficiaries are generally subject to the same rules as other eligible rollovers. Code § 402(c)(11) & (f)(2); WRERA § 108(f).

3. SOA Notice of Blackout Periods. The Sarbanes-Oxley Act of 2002 amended ERISA to require that participants of a 401(k) or other individual account plan be provided advance notice of a blackout period during which the ability to make investment changes will be restricted. The notice requirement does not apply to “one-participant plans.” WRERA provides that a “one-participant plan” means a retirement plan that: (1) covers only one individual (or individual and spouse) and such individual owns 100% of the plan sponsor, or (2) covers only one or more partners (or partners and spouses) in the plan sponsor. ERISA § 101(i)(8)(B); WRERA § 105(g). Thus, plans that are not subject to Title I of ERISA are not subject to the blackout notice provisions. This provision is effective as if included in the Sarbanes-Oxley Act.

4. Diversification for One-Participant Plan. Under PPA, the diversification requirements do not apply with respect to one-participant retirement plans. WRERA conforms the Code definition of the term “one-participant retirement plan” to the definition of the term under ERISA. Code § 401(a)(35)(E)(iv); WRERA § 109(a).

5. Increasing Participation Through Eligible Automatic Contribution Arrangements (EACAs). PPA allows an employee to withdraw eligible automatic contribution arrangements (“EACAs”) within 90 days. Code § 414(w). WRERA repeals the requirement that an eligible automatic contribution arrangement satisfy, in the absence of a participant investment election, the requirements of ERISA § 404(c)(5) under which a participant is treated as exercising control over the assets in the participant’s account with respect to default investments. WRERA § 109(b)(4) deleting Code § 414(w)(3)(C). WRERA also extends the permissible withdrawal rules to SIMPLE IRAs and SARSEPs. Code § 414(w)(5); WRERA § 109(b)(5). WRERA also provides that a permissive withdrawal is disregarded for purposes of applying the § 402(g) annual limit on elective deferrals. Code § 414(w)(6); WRERA § 109(b)(6).

6. Income From Distribution of Excess Contributions and Excess Deferrals. PPA provides that income allocable to distribution of ADP excess contributions or ACP excess aggregate contributions must be distributed through the end of the year for which the distribution is made. Code § 401(k)(8)(E). WRERA applies this rule to the amount of income that must be distributed to the excess deferrals and allocable income under Code § 402(g). Code § 402(g)(2)(A)(ii); WRERA § 109(b)(3).

7. Termination of Eligible Combined Defined Benefit and 401(k) Plans. Under PPA, a qualified small employer may establish a combined plan that consists of a defined benefit plan and a 401(k) cash or deferral arrangement, provided that certain requirements are satisfied. Code § 414(x)(1). PPA also provides that the rules of ERISA are applied to the defined benefit component and the individual account component as if each component were a separate plan. WRERA provides that in the case of a termination of a combined plan, the individual account and defined benefit components must be terminated separately. Code § 414(x)(1); WRERA § 109(c).

F. 2009 Waiver of Required Minimum Distribution Rules for Defined Contribution Plans and IRAs. Under the Code § 401(a)(9) required minimum distribution rules, qualified plans and IRAs must begin to receive benefits (the required beginning date) by April 1 following the year in which the participant attains age 70½ (or for qualified plans, the year in which he or she retires, if later). Defined contribution plan distributions are determined based on the previous December 31 value, and are divided over the life expectancy of the participant and paid each year. WRERA provides that no minimum distribution is required for 2009. If the participant attains age 70½ or terminates in 2009, no distribution would be required on April 1, 2010. The next required minimum distribution for the 2010 calendar year must be made by December 31, 2010. Code § 401(a)(9)(H); WRERA § 201(a). The waiver does not apply to distributions for 2008 or 2010 calendar years. The waived minimum distribution is still treated as not subject to eligible rollover distribution and is not subject to 20% withholding. Code § 402(c)(4); WRERA § 201(b).

G. WRERA Provisions Relating to Multiemployer Plans.

1. Implementation and Enforcement of Default Schedule for Multiemployer Plan. Pursuant to PPA under Code §§ 432(c)(7) and 432(e)(3)(C), with respect to a multiemployer plan, a default schedule applies if a funding improvement plan or rehabilitation plan is not timely adopted. WRERA removes the rule that the default schedule is implemented on the date the DOL certifies that the parties are at impasse, and therefore under WRERA a default schedule is only required within 180 days of the expiration date of the collective bargaining agreement. WRERA § 102(b).

2. Restriction on Lump Sum Payments While Multiemployer Plan is in Critical Status. PPA provides in Code § 432(f)(2)(A) that the payment of accelerated forms of payment, including lump sums, while a plan is in critical status is restricted. WRERA provides that the restriction on payment of accelerated forms of payment applies only to participants whose benefit commencement date is after the notice of the plan’s critical status is provided. This change conforms the rule for multiemployer plans to the rule applicable to single-employer plans. WRERA § 102(b).

3. Access to Multiemployer Pension Plan Information. Under PPA, participants and employers in a multiemployer plan are entitled to receive copies of certain financial reports prepared by an investment manager, advisor or other fiduciary, upon request. ERISA § 101(k). However, no individually identifiable information regarding any participant, fiduciary, or contributing employer may be disclosed. WRERA clarifies that this prohibition does not prevent the plan from disclosing the identities of the investment managers or advisors, or any other person preparing a financial report, whose performance is being reported on or is being evaluated. ERISA § 101(k)(2); WRERA § 105(b).

4. Temporary Delay of Designation of Multiemployer Plans as Endangered or in Critical Status. Under Code § 432 additional funding rules apply to multiemployer defined benefit plans that are in endangered or critical status. Annual certifications of status are required. Under WRERA, the sponsor of a multiemployer defined benefit plan may elect for a plan year beginning in the period form October 1, 2008 and September 30, 2009 to treat the plan’s status for purposes of § 432 the same as the plan’s status for the preceding plan year. Thus a calendar year plan that is not in critical or endangered status for 2008 may elect to retain its non-critical and non-endangered status for 2009. An election under this provision may only be revoked with the consent of the Treasury. WRERA § 204.

H. Other Miscellaneous WRERA Provisions.

1. PBGC Missing Participant Program Expanded to All Qualified Plans. WRERA extends the missing participant program under ERISA § 4050 to all qualified plans even those that have at no time provided for employer contributions. ERISA § 4050(d)(4)(A); WRERA § 104.

2. Periodic Pension Benefit Statements. PPA revises the rules with respect to a plan administrator’s obligation to provide periodic information relating to a participant’s accrued benefits under ERISA § 105. WRERA makes conforming changes to ERISA § 209, which imposes recordkeeping and reporting obligations with respect to participant benefits. ERISA § 209(a); WRERA § 105(f).

3. Technical Corrections to the PPA Prohibited Transaction Rule Relating to Financial Investments. PPA provides for an exemption from ERISA’s prohibited transaction rules in the case of foreign exchange transactions between a plan and a bank or broker-dealer if certain requirements are met, including the requirement that the exchange rate used cannot deviate by more or less than 3% from the Interbank bid and asked rates for transactions of comparable size and maturity. Under WRERA, the exchange rate cannot deviate by more than 3%. ERISA § 408(b)(18)(C); WRERA § 106(b).

4. Use of Excess Pension Assets for Future Retiree Health Benefits and Collectively Bargained Retiree Health Benefits. In a Code § 420 transfer, the funded status of the defined benefit plan must be maintained by employer contributions or asset transfers from health accounts. Under WRERA, asset transfers from health accounts to maintain the plan’s funded status are not subject to the excise tax on reversions. Code § 4980(c)(2)(B); WRERA § 108(i)(3). WRERA also allows assets in a § 420 transfer to be used to pay health liabilities in excess of current-year retiree health liabilities. Code § 420(c)(1)(A); WRERA § 108(i)(1).

5. No Reduction in Unemployment Compensation as a Result of Pension Rollovers. Under prior law, unemployment compensation payable by a State was generally reduced by the amount of retirement benefits received by the individual. Under PPA, the State has the option to include or not include rollover contributions in retirement payments for purposes of reducing unemployment compensation under Federal law. Code § 3304(a)(15). Under WRERA, unemployment compensation payable by a State to an individual may not be reduced by the amount of a rollover contribution. Code § 3304(a)(15)(B); WRERA § 111.

6. Reimbursements From Governmental Plans for Medical Care. WRERA provides that for the Code § 105(b) exclusion for reimbursements for medical expenses, amounts paid from a specified health plan (i.e., a plan funded by a medical trust that is established for a public retirement system authorized by a state and with a favorable IRS ruling. Code § 105(j): WRERA § 124.