2025 Executive Order on Democratizing

401(k) Access to Alternative Assets

By Charles C. Shulman, Esq.

On August 7, 2025, President Trump issued an executive order titled “Democratizing Access to Alternative Assets for 401(k) Investors”, which directs the Department of Labor to revise existing guidance and consider regulatory changes to facilitate alternative asset inclusion in 401(k) plans.

On June 3, 2020, under the first Trump administration, the DOL issued an Information Letter stating that ERISA does not expressly prohibit private equity investments within a professionally managed asset allocation fund offered in a 401(k) plan. On Dec. 21, 2021, under the Biden administration, the DOL issued a Supplemental Statement that discouraged fiduciaries from considering alternative assets in 401(k) retirement plan investments, casting doubt on the 2020 letter. The 2021 Supplemental Statement warned that fiduciaries of small, individual account plans were not likely suited to evaluate such investments, effectively precluding access for most plan sponsors.

The 2025 Executive Order directs the DOL the SEC to reassess existing fiduciary guidance under ERISA and consider regulatory changes that would enable plan sponsors to include alternative assets in professionally managed asset allocation funds. It also calls for the creation of safe harbor provisions to protect fiduciaries from excessive litigation when making prudent investment decisions involving alternative assets, with the goal of ensuring that fiduciaries can balance the potential for higher long-term returns and diversification against the risks and costs associated with these complex investments. It mandates proposing rules or safe harbors within 180 days to reduce litigation risks, which deter fiduciaries due to fears of excessive fee or underperformance lawsuits.

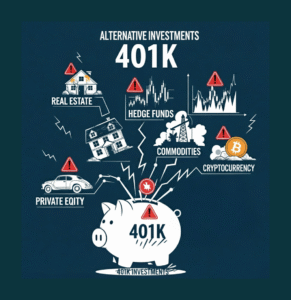

The Executive Order defines “alternative assets” broadly, including private market investments, real estate holdings, digital assets, commodities, infrastructure projects, and longevity risk-sharing pools.

On August 12th, 2025, the DOL rescinded a December 21st, 2021, Supplemental Statement that discouraged fiduciaries from considering alternative assets in 401(k) plans.

The Executive Order signals a policy shift to expand 401(k) access to alternative assets by reducing regulatory and litigation barriers. However, while awaiting further regulatory clarity from the government and even after such guidance, there are certain factors to keep in mind when considering adding alternative investments to a 401(k) plan:

- ERISA’s core fiduciary duties of prudence, loyalty, and diversification remain unchanged, and fiduciaries must act solely in participants’ best interests, using care, skill, and diligence when considering alternative assets like private equity, real estate, or cryptocurrencies.

- Future DOL guidance under the Trump administration may be challenged in court or reversed by a future administration.

- There is still a potential for increased fiduciary liability for plan administrators due to (i) the risk that the alternative investments will significantly underperform or lead to participant losses, and (ii) inherently complex and illiquid nature of alternative assets and (iii) the higher fees.

- A thorough , well-documented process for selecting and monitoring investments is critical to comply with ERISA’s fiduciary obligation and help defend against potential litigation.

- Plan sponsors and fiduciaries should strengthen due diligence, update investment policy statements, increase participant education and monitor regulatory developments to navigate this evolving landscape.

- Congressional action may be needed for significant litigation reform due to ERISA’s private right of action.

- Alternative assets pose risks due to illiquidity, high fees, valuation complexities, and volatility, requiring fiduciaries to balance potential returns and diversification benefits against these challenges.

- The participant-directed nature of 401(k) plans, which relies on participants making their own investment choices, may not be well suited for alternative assets, which often require sophisticated knowledge and long-term commitment.