Charles C. Shulman, Esq.

2026 BENEFIT PLAN COST-OF-LIVING ADJUSTMENTS *

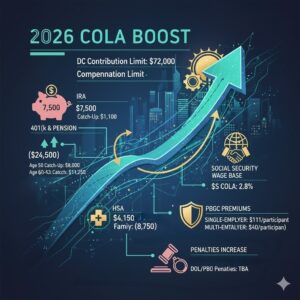

The chart below summarizes the 2026 cost-of-living adjustments affecting 401(k), defined benefit, ESOP and other retirement plans, IRAs, HSAs, Social Security, PBGC premiums, and related tax and benefit thresholds. These updated limits—issued through IRS guidance, Social Security and PBGC releases, and federal penalty inflation adjustments in the Federal Register—reflect the new contribution caps, compensation limits, savings incentives, and compliance amounts that apply for the 2026 plan and tax year, compare to prior years.

| BENEFIT PLAN COST-OF-LIVING ADJUSTMENTS | 2025 | 2026 |

|---|---|---|

| Retirement Plan Limits | ||

| 402(g) Deferral Limit – Annual limit on pre-tax salary deferrals to 401(k), 403(b) and 457(b) plans – IRC §§ 402(g)(1), 402(g)(3) & 457(e)(15) | $23,500 | $24,500 |

| Age 50 Additional Catch-Up Deferrals – Age 50 & older “catch-up” deferrals beyond the 402(g) limit above available for 401(k), 403(b), & governmental 457(b) plans – IRC § 414(v)(2)(B)(i). | $7,500 | $8,000 |

| Under the SECURE 2.0 Act of 2022 (SECURE 2.0) § 603 the catch-up for highly-compensated employees (in the previous year) to a qualified plan (401(k), 403(b) & 457(b)) will need to be Roth contributions beginning in 2026. Also, under SECURE 2.0 § 109, beginning in 2025 the catch-up for those ages 60-63 will be 150% of the general catch-up limit. | $11,250 for those age 60-63 | $11,250 for those age 60-63 |

| Prior year wage threshold triggering Roth catch-up contributions to defined contribution plans ($145,000 for 2023-2025 but IRS has delayed enforcement of this limit until 2026) – IRC § 414(v)(7) | N/A | $150,000 |

| DB Benefit Limit – Limit on annual benefits from defined benefit plans – IRC § 415(b) | $280,000 | $290,000 |

| DC Contribution Limit – Annual contribution limit for defined contribution plans & SEP IRA – IRC §§ 415(c) & 408(d)(5)(A) | $70,000 | $72,000 |

| Compensation Limit – Annual compensation limit for qualified plans and SEPs – IRC §§ 401(a)(17), 404(l) & 408(k) | $350,000 | $360,000 |

| Grandfathered § 401(a)(17) annual compensation limit for governmental plans in effect on July 1, 1993 – Treas. Reg. § 1.401(a)(17)-1(d)(4)(ii) | $520,000 | $535,000 |

| Highly Compensated Employee - Highly compensated employee threshold for nondiscrimination testing in the following year – IRC § 414(q)(1)(B) | $160,000 | $160,000 |

| Key Employee Officers in Top Heavy Plan – Key employee threshold for officers in top heavy plans – IRC § 416(i)(1)(A)(i) | $230,000 | $235,000 |

| Contribution limit to Emergency Savings Accounts for DC plans – IRC § 402A(e)(3)(A) | $2,500 | $2,600 |

| Starter 401(k) Deferral Arrangements – Elective contributions to starter 401(k) deferral-only arrangements ) (higher amounts if age 50 or over) - IRC § 401(k)(16)(D) | $6,000 | $6,000 |

| QLAC Limit – Limit on premiums for qualified longevity annuity contracts (QLACs) under Treas. Reg. § 1.401(a)(9)-6 Q&A 17 increased from $150,000 to $210,000 under SECURE 2.0 § 202 for contracts purchased or received on or after Dec. 29, 2022 | $210,000 | $210,000 |

| ESOP Distributions – (i) minimum account balance allowing extension of distribution period beyond 5 years; and (ii) dollar amount (or fraction) in excess of minimum account balance allowing extension of distribution period for additional year – IRC § 409(o)(1)(C)(ii) | (i) $1,415,00 (ii) $280,000 | (i) $1,455,00 (ii) $290,000 |

| Mandatory Lump-Sum Cashout Limit – The SECURE 2.0 Act of 2022 increases the lump-sum cashout amount subject to the automatic rollover IRAs from $5,000 to $7,000 (not indexed) for distributions made after Dec. 31, 2023 – IRC §§ 411(a)(11)(A) & 401(a)(31)(B)(ii) | $7,000 | $7,000 |

| SIMPLE Salary Deferral Limit – SIMPLE 401(k) or SIMPLE IRA elective deferral limit (10% higher if fewer than 25 employees or if certain higher employer contributions are made) – IRC § 408(p)(2)(E) | $16,500 | $17,000 |

| SIMPLE Catch-Up for Age 50 – SIMPLE 401(k) or SIMPLE IRA age 50 catch-up – IRC § 414(v)(2)(B)(ii). (10% higher if fewer than 25 employees or if certain higher employer contributions are made). Under SECURE 2.0, beginning in 2025 the catch-up for SIMPLE plans for those ages 60-63 is increased in 2025. | $3,500 $5,250 if age 60 to 63 | $4,000 $5,250 if age 60 to 63 |

| SEP Earnings Level – Minimum earnings level to qualify for Simplified Employee Pension (SEP) IRA – IRC § 408(k) | $750 | $800 |

| Saver’s Credit – A “saver’s credit” under IRC § 25B(b) provides a tax credit for salary deferrals to a 401(k) or 403(b) plan or contributions to an IRA for those with AGI below a certain level, with a credit (for married filing jointly) of (i) 50% of contribution if AGI is not more than a specified dollar amount, (ii) 20% if AGI is in a specified dollar range and (iii) 10% if AGI is in higher specified dollar range. Single and married filing separately have lower limits. (Effective for plan years beginning 2027, SECURE 2.0 § 103 sunsets the § 25B saver’s credit and replaces it with a federal matching contribution under IRC § 6433, which is 50% of the contributions up to $2,000 per individual, but phases out if AGI is between $41,000 and $71,000 for married filing jointly, and $20,500 to $35,500 for single taxpayers and married filing separate returns.) | (i) $47,500, (ii) $47,501 - $51,000, (iii) $51,001 - $79,000 | (i) $48,500, (ii) $48,501 - $52,500, (iii) $52,501 - $80,500 |

| IRA Limits | ||

| IRA Limit – Traditional IRA and Roth IRA contribution limit is indexed – IRC §§ 219(b)(5)(A), 408(a)(1) & 408A(c)(2) | $7,000 | $7,500 |

| Spousal IRA Contribution Limit – A spousal IRA or spousal Roth IRA where both spouses contribute is double the above. | $14,000 | $15,000 |

| IRA Catch-up Contribution - Age 50 & older “catch-up” for IRAs & Roth IRAs (not currently adjusted but under SECURE 2.0 § 108 may be adjust beginning in 2025) – IRC § 219(b)(5) | $1,000 | $1,100 |

| Phaseout where IRA Owner is also Covered by an Employer Plan – Adjusted gross income (AGI) phase-out of deductible contribution to IRA if individual is also covered by employer-sponsored retirement plan for: (i) married filing jointly, (ii) single or (iii) married filing separately – IRC § 219(g)(1)-(5) | (i) $126,000 - $146,000, (ii) $79,000 - $89,000, (iii) 0 - $10,000 | (i) $129,000 - $149,000, (ii) $81,000 - $91,000, (iii) 0 - $10,000 |

| Phaseout where Spouse of IRA Owner is Covered by an Employer Plan – AGI phase-out of deductible contribution to IRA if contributor is not covered by an employer-sponsored plan but spouse is covered by an employer-sponsored plan – IRC § 219(g)(7) | $236,000-$246,000 | $242,000-$252,000 |

| Phaseout of Roth IRA Contributions – AGI phase-out deduction for contributions to the Roth IRA for (i) married filing jointly, (ii) single or (iii) married filing separately – IRC § 408A(c)(3)(B) | (i) $236,000 - $246,000, (ii) $150,000 - $165,000, (iii) 0 - $10,000 | (i) $242,000 - $252,000, (ii) $153,000 - $168,000, (iii) 0 - $10,000 |

| PBGC Premiums & Guarantee | ||

| PBGC Flat-Rate Premium – PBGC flat-rate premium per participant for a single-employer plan (under ERISA § 4006 & PBGC Premium Rates webpage) | $106 | $111 |

| PBGC Variable-Rate Premium - PBGC variable-rate premium for single-employer plans (i) per $1,000 of Unfunded Vested Benefits (no longer indexed after 2025, per SECURE 2.0), and (ii) per participant cap. | (i) $52 (ii) $717 | (i) $52 (ii) 751 |

| (ii) $717 | (i) $52 | |

| (ii) 751 | ||

| Multiemployer Premium - PBGC premium for multiemployer plan per participant | $39 | $40 |

| PBGC Guaranteed Benefit - PBGC guaranteed benefits under ERISA § 4022 where PBGC is the trustee (for annual single life annuity beginning at age 65) | $89,181.84 ($7,431.82 a month) | $93,477.24 ($7,789.77 a month) |

| Health Plan Limits | ||

| Health FSA Limit – Health FSA (flexible spending account) limit – IRC § 125(i) | $3,300 | $3,400 |

| Heath FSA Carryover – Health FSA carryover amount | $660 | $680 |

| HRA Contribution Limit –Maximum employer contribution for excepted benefit HRA – Treas. Reg. § 54.9831-1(c)(3)(viii)(B) | $2,150 | $2,200 |

| QSEHRA Limit – Qualified small employer HRA (QSEHRA) for business with less than 50 employees and maximum payments for (i) single coverage and (ii) family coverage – IRC § 9831(d) | (i) $6,350 (ii) $12,800 | (i) $6,450 (ii) $13,100 |

| HDHP Deductible – High Deductible Health Plan (with HSA) minimum deductibles for (i) self-only or (ii) family coverage – IRC § 223(c) | (i) $1,650 (ii) $3,300 | (i) $1,700 (ii) $3,400 |

| HSA Limit – Health Savings Account (HSA) deduction limit for (i) single & (ii) family – IRC § 223(b)(2) | (i) $4,300 (ii) $8,550 | (i) $4,400 (ii) $8,750 |

| HDHP Out of Pocket – HDHP (with HSA) maximum out-of-pocket amounts for (i) self-only & (ii) family coverage – IRC § 223(c) | (i) $8,300 (ii) $16,600 | (i) $8,500 (ii) $17,000 |

| QSEHRA Limit – Qualified small employer HRA (QSEHRA) for small business (less than 50 employees) and the maximum payments and reimbursements (i) single coverage and (ii) family coverage – IRC § 9831(d) | (i) $6,350 (ii) $12,800 | (i) $6,450 (ii) $13,100 |

| MSAs – Existing Archer Medical Savings Accounts have annual deductible range (i) for single coverage & (ii) for family coverage, and out-of-pocket maximum (iii) for single coverage and (iv) for family coverage – IRC § 220(c)(2)(A) | (i) $2,850 - $4,300, (ii) $5,700 - $8,550, (iii) $5,700 (iv) $10,500 | (i) $2,900 - $4,400, (ii) $5,850 - $8,750, (iii) $5,850 (iv) $10,700 |

| ACA Out of Pocket Maximum – Affordable Care Act (ACA) out-of-pocket maximum (cost-sharing) for non-grandfathered group health plans for (i) self & (ii) family – 42 USC § 18022(c); 45 CFR § 156.130(a) | (i) $9,200 (ii) $18,400 | (i) 10,600 (ii) $21,200 |

| ACA Affordability Rate – ACA health plan “affordability” rate of pay (percentage of household income) for premium tax credit – IRC § 36B(c)(2)(C)(i)(II) | 9.02% | 9.96% |

| ACA Pay or Play Penalties – ACA employer shared responsibility assessments (i) if do not offer coverage to 95% of full-time employee, penalty for each FTE; and (ii) if do offer coverage to 95% of FTEs but is not “affordable” penalized only for employees who buy Marketplace coverage and receive premium tax credit – IRC § 4980H | (i) $2,900 (i) $4,350 | (i) $3,340 (i) $5,010 |

| Fringe Benefits | ||

| Transportation Fringe – Qualified transportation & parking benefit – IRC § 132(f)(2) | $325 | $340 |

| Adoption – Adoption credit or exclusion from income (i) amount and (ii) AGI phaseout – IRC §§ 23(a)(3) & 137(a)(2) | (i) $17,280, (ii) $259.190 - $299,190 | (i) $17,670, (ii) $265,080 - $305,080 |

| LTC Deduction Limit – Long-term care premium deduction limits for individuals (i) age 40 or less, (ii) age 41-50, (iii) age 51-60, (iv) age 61-70 and (v) over age 70 – IRC § 213(d)(10) | (i) $480, (ii) $900, (iii) $1,800, (iv) $4,810 & (v) $6,020 | (i) $500, (ii) $930, (iii) $1,860, (iv) $4,960 & (v) $6,200 |

| Social Security | ||

| Taxable Wage Base – The taxable wage base subject to FICA (OASDI) tax (SSA COLA Fact Sheet) | $176,100 | $184,500 |

| SS Tax up to Taxable Wage Base – Social Security (OASDI) tax up to taxable wage base (double for self-employed) | 6.2% | 6.2% |

| Medicare Tax – Medicare tax and no cap on wages (plus 0.9% Medicare tax for wages in excess of $250,000 (joint filers) / $210,000 (single)) | 1.45% | 1.45% |

| SS COLA – Social Security cost of living increase | 2.5% | 2.8% |

| SS Annual Earnings Test – For Social Security benefits claimed before reaching full retirement age (age 67 for anyone turning 65 in 2026 or later), annual earnings above the following threshold reduce benefits(generally $1 for every $2 in earnings over the cap) | $23,400 | $24,480 |

| Penalties | ||

| DOL Penalties – Sample DOL penalties:(i) Penalty per day for failure to file annual report (Form 5500) - ERISA § 502(c)(2) (originally $1,000 per day); (ii) Penalty per day for failure to provide certain notices for events relating to limitations for severe funding shortfalls and relating to withdrawal liability – ERISA § 502(c)(4) (originally $100 per day); (iii) Penalty per day for failure to provide blackout or diversification notice – ERISA § 502(c)(7) (originally $100 per day) | (i) $2,739 (ii) $2,167 (iii) $173 | TBA |

| PBGC Penalties | (i) $2,739 (ii) $365 | |

| (i) PBGC penalty per day for failure to provide required notices or other material information with respect to single employer Title IV plans of up to: | ||

| (ii) PBGC penalty per day for failure to provide certain notices relating to multiemployer plans of up to: |

See Notice 2025-67, Rev. Proc. 2025-32, Rev. Proc. 2025-19, Social Security Administration News Release, PBGC Premium Rates and Federal Register adjustment of penalties January 2026.