“AFFILIATED SERVICE GROUP” RULES

By Charles C. Shulman

Printed in 51 Journal of Pension Planning and Compliance, no. 4, at 1 (WK, Winter 2026).

This article explains when separate service or management entities are treated as a single employer under Internal Revenue Code § 414(m) for qualified plan and certain welfare plan purposes. It traces the origins of the affiliated service group rules, distinguishes them from ERISA controlled group rules, and provides practical guidance on A-Org, B-Org, and management organization affiliated service groups, including ownership attribution and recent statutory developments.

1. Affiliated Service Group Rules Generally and Background

Under Internal Revenue Code (“Code”) § 414(m), employees of trades or businesses that are members of an “affiliated service group” are treated as employed by a single employer, for purposes of nondiscrimination testing and other qualified plan rules under the Code (but not for purposes of liability under Title IV of the Employee Retirement Income Security Act (“ERISA”)).

Reason for Enactment of Code § 414(m) Affiliated Service Rules

Code § 414(m) was enacted in 1980 to ensure that certain nondiscrimination rules that are intended to prevent qualified plans disproportionately benefiting highly-compensated employees, could not be circumvented through the use of separate entities. Many professionals, relying on the Kiddie-Garland line of decisions, had placed their common-law employees into partnerships composed of their professional service corporations to exclude rank-and-file employees from participation in the qualified retirement plans of the professional corporations.

The affiliated service group rules under Code § 414(m) were enacted as part of the Miscellaneous Revenue Act of 1980 in response to two cases—Thomas Kiddie, Inc. v. C.I.R., 69 T.C. 1055 (1978), and Garland v. C.I.R., 73 T.C. 5 (1979), where two sets of physicians incorporated their medical practices as PCs (or in the case of Garland one physician incorporated his medical practice) and these physician PCs (or in the case of Garland one PC and one physician) formed a partnership with the partnership employing the non-doctor employees of the medical practice. The physician PCs were allowed in these cases to set up qualified retirement plans for the physicians even though no qualified retirement plan was set up for the partnership’s rank-and-file employees, because, prior to the 1980 legislation, the physician PCs were not aggregated with the partnership medical group for nondiscrimination purposes under the Code rules.

In response to this perceived abuse, Code § 414(m) was enacted under the Miscellaneous Revenue Act of 1980, requiring that certain related service organizations must be treated as a single employer.

The Tax Equity and Fiscal Responsibility Act of 1982 expanded the affiliated service group rules by adding new Code § 414(m)(5) to include a management service organization that regularly performs management functions for another organization (or for a group of related organizations) as an affiliated service group with such organization(s).

2. Where Affiliated Serviced Group Rules are Applied

Pursuant to Code § 414(m)(4), employees of trades or businesses that are members of an affiliated service group are treated as employed by a single employer for the following qualified plan rules: (i) minimum coverage under Code § 410(b), nondiscrimination testing under § 401(a)(4) and regulations (including general test and benefits, rights and features test), ADP/ACP testing under § 401(k) & 401(m), minimum participation under § 401(a)(26), minimum participation under § 410, minimum vesting under § 411, annual addition limit under § 415, top-heavy limit under § 416 and compensation limit under § 401(a)(17) (Code §§ 414(m)(4)); and (ii) simplified employee pension (SEP) rules under Code § 408(k) and Simple retirement accounts rules under Code § 408(p) (Code § 414(m)(4)(B)).[1]

The affiliated service group rules are also applicable to the following welfare plan requirements: (i) medical reimbursement plan coverage under Code § 105(h), cafeteria plans under Code § 125, accident and health plan rules of Code § 106 and fringe benefit rules of Code § 132 (Code § 414(t), 105(h)(8) & 125(g)(4)); (ii) Affordable Care Act mandated coverage rules for employers with 50 or more employees on a controlled group basis, to provide affordable healthcare benefits or pay certain penalties under Code § 4980H(a) & (b) (Code § 4980H(c)(2)(C)(i); Treas. Reg. § 54.4980H-1(a)(16)); and most likely (iii) COBRA continuation coverage rules, for although ERISA § 607(4) only references the “controlled group” rules of Code § 414, Code § 414(t) and Rev. Rul. 2003-70 reference Code § 414(b) & (c) and § 414(m).

However, in contrast to ERISA controlled group rules under Code § 414(b) & (c), affiliated service group rules under Code § 414(m) do NOT apply to: (i) liability under Title IV of ERISA (ERISA § 4062(a) only references Code § 414(b) & (c), not (m)); or (ii) Code § 409A restrictions on nonqualified deferred compensation plans (Code § 409A(d)(6) only references Code § 414(b) & (c), not (m)). Also, affiliated service group rules (like controlled group rules) would not apply to: (i) prohibited transaction rules; (ii) other excise taxes; (iii) consequences of plan disqualification; (iv) Title I reporting and disclosure obligations; and (v) contractual liabilities for promised benefits.

3. Controlled Group Rules Separate from Affiliated Service Group Rules

Under the Code and ERISA, employees of certain related “controlled group” entities, as defined in § 414(b) & (c) of the Code, are treated as employed by a single employer, for purposes of liability under Title IV of ERISA, qualified plan nondiscrimination testing under the Code and various other rules. For a thorough discussion of the ERISA controlled group rules, see my recent article, “ERISA’s ‘Controlled Group’ Rules – A Timely Review,” published in 51 Journal of Pension Planning and Compliance, no. 1, at 1 (WK, Fall 2025). [See https://ebeclaw.com/erisa-controlled-group-rules/ ]

Note that the rules for treatment of an “affiliated service group” as a single employer under Code § 414(m) and the rules for treatment of “controlled group” entities as a single employer under Code § 414(b) & (c) are to be applied separately. Prop. Treas. Reg. § 1.414(m)-1(a), 48 Fed. Reg. 8293 (Feb. 28, 1983), provides that if aggregation is required under either of Code § 414(b) or 414(c) and also under § 414(m), the requirements with respect to all of the applicable provisions must be satisfied. As interpreted in Tech. Advice Memo. 201715001 (April 14, 2017), both the controlled group set of rules and the affiliated service group of rules must be applied, and therefore Entity 2 could be in the same controlled group of Entity 1 under § 414(c) even though Entity 2 is an affiliated service group of Entity 3. In that case Entity 1 and Entity 2 each had a qualified defined contribution plan, the Code § 415(c) limits would apply on a controlled group aggregated basis.

4. Types of Affiliated Service Groups

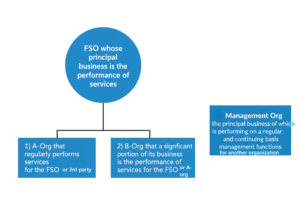

A-Org or B-Org Affiliated Service Groups Under Code § 414(m)(2). An affiliated service group under § 414(m) is a group consisting of:

i. a “first service organization” (“FSO”)—which is a “service organization,” and is defined in § 414(m)(3) as an organization whose principal business is the performance of services;

AND

ii. one of the following:

(a) an “A-Org” under § 414(m)(2)(A)—a service organization (i.e., one whose principal business is the performance of services); (1) that is a “shareholder or partner of the FSO” (without regard to the amount of percentage interest), and (2) that “regularly performs services for” the FSO or is “regularly associated with” the FSO in performing services for third parties;

OR

(b) a “B-Org” under § 414(m)(2)(B)—any organization other than an A-Org if (1) a “significant portion” of the B-Org’s business is the performance of services for the FSO or for an A-Org, and (2) at least 10% of such organization is owned by highly compensated employees[2] of the FSO (both prongs must be met to be a B-Org affiliated service group).

Organization. The proposed IRS regulations under Code § 414(m)(2) provide that an “organization” under § 414(m) includes a corporation, partnership, sole proprietorship or any other type of entity regardless of its ownership form. Prop. Treas. Reg. § 1.414(m)-2(e)(1), 48 Fed. Reg. 8293 (Feb. 28, 1983).[3]

5. Constructive Ownership

Code § 414(m)(6) and other IRS guidance provides that in determining ownership under § 414(m), the family and entity ownership attribution rules of Code § 318(a) apply.

Stock or partnership interests owned, directly or indirectly, by or for a corporation, partnership, estate, or trust are considered as being owned proportionately by or for its shareholders, partners, or beneficiaries. An individual owning (otherwise than by the application of the rule immediately above) any stock in a corporation or interest in a partnership is treated as owning the stock or partnership interests owned, directly or indirectly, by or for his partner. Code § 318(a).

Code § 318(a)(2)(C) looks through to underlying interests owned by a corporation if there is a 50% ownership by a person in the corporation. However, Code §§ 318(a)(2)(A) and 318(a)(3)(A) provide that stock owned by or for a partnership or partner will be considered owned proportionately by the partner or owned by the partnership without regard to whether there is a 50% ownership interest.[4]

The SECURE 2.0 Act of 2022 amended Code § 414(m)(6)(B) to streamline family attribution rules, effective for plan years beginning in 2024, so that: (i) community property laws are ignored when applying family attribution rules under Code § 318, allowing businesses owned by spouses to be treated as separate for aggregation purposes, even in community property states, if there is no direct ownership or management in each other spouse’s businesses; and (ii) if stock ownership is not attributed to a spouse due to legal separation (via divorce or separate maintenance decree) under Code § 318(a)(1)(A)(i), it generally will not be attributed to the spouse via minor children (under age 21) under the minor child attribution rule.

6. Determination of Affiliated Service Group Status as Part of Determination Letter Prior to 2017

Prior to 2017, IRS Form 5300 and Rev. Proc. 2016-6, § 14, provided for IRS determination letter requests for affiliated service group status under Code § 414(m) (but only as part of the process of submitting a qualified plan for a determination as to its qualified status. Instructions to Form 5300). IRS Publication 7005 (last updated April 2016)—Employee Benefit Plans Explanation No. 10 Affiliated Service Group (determination letter flow-chart) was used to assist IRS agents in making affiliated service group determination letter rulings. Note that even before Rev. Proc. 2017-4, an IRS private letter ruling request, separate from the IRS determination letter requested, was not available for affiliated service group status, as stated in Rev. Proc. 2016-4, § 6.03. However, Rev. Proc. 2017-4, which modified the procedures for requesting determination letters, provides that beginning in 2017 the IRS will no longer issue determination letters as to whether the plan sponsor is part of an affiliated service group. Rev. Proc. 2017-4, 2017-1 I.R.B. 146, § 2.02 (procedures for requesting determination letters were modified to reflect that employers that maintain individually designed plans may no longer request determination letters on whether a plan sponsor is part of an affiliated service group).

7. A-Org Affiliated Service Group

An “A-Org” affiliated service group under § 414(m)(2)(A) is a group consisting of:

i. a “first service organization” (“FSO”)—which is a “service organization,” which is defined in § 414(m)(3) as an organization whose principal business is the performance of services;

AND

ii. an A-Org under § 414(m)(2)(A)—which is a service organization (i.e., one whose principal business is the performance of services); (1) which is a “shareholder or partner of the FSO” (without regard to the amount of percentage interest), and (2) “regularly performs services for” the FSO or is “regularly associated with” the FSO in performing services for third parties.

Code § 414(m)(2)(A).

De Minimis Ownership of A-Org in FSO

There is no ownership threshold of the A-org in the FSO, and even a de minimis ownership should suffice.[5]

Standard for A-Org Regularly Performing Services for FSO (or with FSO)

Prop. Treas. Reg. § 1.414(m)-2(b) provides that the determination of “regularly performing services for” or “regularly associated with” is made on the basis of facts and circumstances with one factor being the amount of earned income the “A” Org derives from performing services for the FSO or for the third party.

The proposed regulations give three examples of what regularly performing services or regularly associated means: (1) Where an attorney forms a professional service corporation and that PC is a partner in a law firm, and the PC and the law firm are regularly associated in performing services for third persons, they are affiliated service groups. (2) Where a corporation which is a shareholder of, and regularly performs services for another corporation, and both are service organizations but neither is a professional service corporation, there is no affiliation because there is no FSO. (3) A law firm branch which is a PC and also a partner in the national firm, will be considered affiliates since the branch is a partner in the national law firm and is regularly associated with the national law firm in performance services for third persons. Prop. Treas. Reg. § 1.414(m)-2(b)(3). Examples 1 and 3 imply some clearly “regular” requirement. If only a small portion of the partner or shareholders activities were performed with the FSO it would appear that the “regularly” requirement would not be met.[6]

FSO as Professional Service Corp if A-Org is a Corporation

IRS proposed regulations provide that for purposes of the A-Org affiliated service group test, if the first service organization is a corporation it will not be an FSO unless it is organized under state law as a “professional service corporation” providing professional services, i.e., services provided by certified or public accountants, actuaries, architects, attorneys, chiropodists, chiropractors, medical doctors, dentists, professional engineers, optometrists, osteopaths, podiatrists, psychologists, and veterinarians. Prop. Treas. Reg. § 1.414(m)-1(c), 48 Fed. Reg. 8293 (Feb. 28, 1983). The exemption is pursuant to Code § 414(m) (1). (In contrast, however, with respect to B-Org. affiliated service group test, even if the FSO is a corporation that is not a professional service corporation, it can still be considered to be an FSO.)[7]

Test A-Org in Both Directions

A-Org (or B-Org) affiliated service group status must be tested in both directions, looking at the possibility that the first entity is the FSO and the second entity is the A-Org, as well as the possibility that the first entity is the A-Org and the second entity is the FSO, because an entity that may not be an FSO may still be an A-Org and vice versa.

Examples of FSO and A-Org Affiliated Service Group

Dr. Sarah Thompson, a surgeon, is incorporated as Sarah Thompson, MD, PC, and the PC is a partner in Artful Contours Surgical Group. Sarah Thompson, MD, PC is regularly associated with Artful Contours Surgical Group in plastic surgery offered to the public. Artful Contours Surgical Group is an FSO, and Sarah Thompson, MD, PC is an A-Org because it is a partner in Artful Contours Surgical Group and is regularly associated with Artful Contours Surgical Group to perform services for third parties. Accordingly, Sarah Thompson, MD, PC and Artful Contours Surgical Group constitute an affiliated service group and must be treated if they were employed by a single employer under Code § 414(m)(2)(A).

A typical example of an “A-Org.” affiliated service group is a law or medical partnership (FSO) in which one or more of the partners is incorporated (A-Org.). The incorporated partner owns the shares of his professional corporation and is licensed to practice law or medicine under the laws of the state in which he is incorporated. The incorporated partner and the partnership are regularly associated in performing services for third persons (i.e., clients or patients), or the incorporated partner regularly performs services for the partnership.

In the health field and other areas more difficult issues arise. For example, suppose a physician in sole practice owns a limited partnership interest in an imaging facility (i.e., X-ray, MRI, equipment). The imaging facility partnership’s profits are based on a charge to patients for the X-ray or imaging procedure; it does not receive any income from the radiologist’s charge for interpreting the image. The amount she receives from the facility is not directly related to the number of patients the physician refers to the facility, although the more profit the limited partnership makes, the greater the physician’s share. It is possible that the proposed regulations would treat the physician as an A-Org. and the imaging facility partnership an FSO, because the physician is a service organization licensed to practice medicine, and is a partner in another organization which may be a service organization and together they may be viewed as rendering service to third persons. However, it is questionable whether the doctor and the facility are associated in rendering service to third persons since the doctor acts only as a referrer. If the facility were a corporation, rather than a partnership, these issues might not even arise because of the limitation in the proposed regulations, discussed above, that the FSO, if it is incorporated, be a professional service corporation, as that term is defined in the proposed regulations. Prop. Treas. Reg. § 1.414(m)-2(c) generally.

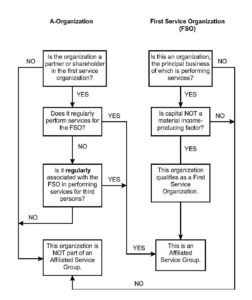

A-Org Flowchart

The following flowchart illustrates the above A-Org affiliated service group rules.

8. B-Org Affiliated Service Group

A “B-Org” affiliated service group under § 414(m)(2)(B) is a group consisting of:

i. a “first service organization” (“FSO”)—which is a “service organization,” which is defined in § 414(m)(3) as an organization whose principal business is the performance of services;

AND

ii. a B-Org under § 414(m)(2)(B)—which is an organization other than an A-Org if (1) a “significant portion” of the B-Org’s business is the performance of services for the FSO or for an A-Org of a type historically performed in such service field by employees, and (2) at least 10% of such organization is owned by highly compensated employees[8] of the FSO. Both prongs must be met to be a B-Org affiliated service group.

Code § 414(m)(2)(B).

Significant Portion of B-Org’s Business is Performance of Services of a Type Historically Performed in such Service Field by Employees

The services must be of a type historically performed by employees in the service field of the FSO or the A-Org. The “historically performed” test will be met if it was not unusual for the service to be performed by employees of the organization in that service field in the United States on December 13, 1980. Prop. Treas. Reg. § 1.414(m)-2(c)(3).

Proposed regulations provide that “significant portion” is a facts-and-circumstances test but further provides that, if gross receipts constitute less than 5% of all services, such receipts are deemed not to be a significant portion. If gross receipts constitute 10% or more of all receipts, such receipts are deemed to be a significant portion. Prop. Treas. Reg. § 1.414(m)-2(c)(2) (proposed in 1983).

A significant portion of the business of the organization is the performance of services for the relevant organization if the “Total Receipts Percentage” is greater than 10%. The Total Receipts Percentage is the ratio of the gross receipts of the organization derived from the FSO and/or A-Organization(s) to the total gross receipts of the organization. If the “Service Receipts Percentage” is less than 5% it will not be considered a significant portion. The Service Receipts Percentage is the ratio of the gross receipts of the organization derived from performing services for the FSO and/or A-Organization(s) to the total gross receipts of the organization derived from performing services. A facts and circumstances test will apply if neither test is met. Prop. Treas. Reg. § 1.414(m)-2(c)(2).

10% of B-Org Held by Officers, Highly-Compensated Employees or Owners of FSO or A-Org

As explained in the proposed regulations, 10% or more of the putative B-Org. organization must be held, in the aggregate, by persons who are designated group members (i.e., the officers, highly compensated employees, and the common owners of an organization) of the FSO or the A-Org., determined by applying the constructive ownership rules. Prop. Treas. Reg. § 1.414(m)-2(c). A “common owner” is a person who is an owner of a FSO or of an A-Org. if at least 3% of the interests in the organization are, in the aggregate, held by persons who are owners of the putative B-Org., determined using constructive ownership rules. Prop. Treas. Reg. § 1.414(m)-2(c). Note that, although Prop. Treas. Reg. § 1.414(m)-2(c)(4)(ii) refers to a “common owner of at least three percent” interest, Code § 414(m)(2)(B)(ii) was amended after the proposed regulations were issued to substitute “highly compensated employees (within the meaning of section 414(q))” for “officers, highly compensated employees, or owners.”

With respect to B-Org affiliated service group test, even if the FSO is a corporation that is not a professional service corporation, it can still be an FSO.

Test B-Org in Both Directions

B-Org (or A-Org) affiliated service group status must be tested in both directions, looking at the possibility that the first entity is the FSO and the second entity is the B-Org, as well as the possibility that the first entity is the B-Org and the second entity is the FSO, because an entity that may not be an FSO may still be a B-Org and vice versa.

Examples of FSO and B-Org as Affiliated Service Group

The Proposed Treasury Regulations give the following as an example of a B-Organization. R is a service organization with 11 partners, each of whom owns 1% of the stock in Corporation D. Corporation D provides services to the partnership of a type historically performed by employees in the service field of the partnership. A significant portion of the business of the corporation consists of providing services to the partnership (i.e., the Total Receipts Percentage is 10% or more). If R is an FSO, Corporation D is a B-Org. because a significant portion of the business of D is the performance of services for the partnership of a type historically performed by employees in the service field of the partnership, and more than 10% of the interests in D are held, in the aggregate, by the designated group members (consisting of the 11 common owners of the partnership). If the ownership of the 11 partners in D stock was reduced to as little as 3% and at least 7% of D’s stock was held by highly compensated employees of R who were not owners of R, the result would be the same. Prop. Treas. Reg. § 1.414(m)-2(c)(8), example (1).

Another example: Desert Horizon Financial Partners is a financial services partnership with 11 partners. Each partner of Desert Horizon owns one percent of the stock in Sagebrush Support Services, Inc. Sagebrush Support Services, Inc. provides services to the partnership of a type historically performed by employees in the financial services field. A significant portion of the business of Sagebrush Support Services consists of providing services to Desert Horizon Financial. Considering Desert Horizon Financial Partners as the FSO, Sagebrush Support Services, Inc. is a B-Org because: (i) a significant portion of its business is in the performance of services for the partnership of a type historically performed by employees in the financial services field; and (ii) more than 10% of the interests in the B-Org, Sagebrush Support Services, Inc., is held, in the aggregate, by the highly-compensated employees of the FSO (consisting of the 11 partners of Desert Horizon Financial Partners). Therefore, Sagebrush Support Services, Inc. (the B-Org) and Desert Horizon Financial Partners (the FSO) constitute an affiliated service group under Code § 414(m)(2)(B).

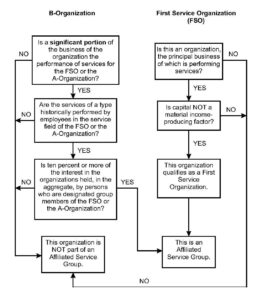

B-Org Flowchart

The following flowchart illustrates the above B-Org affiliated service group rules.[9]

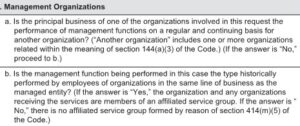

9. Management Organization Affiliated Service Groups Under Code § 414(m)(5)

An affiliated service group also includes, under Code § 414(m)(5), a management organization affiliated service group, which is a group consisting of: (1) an organization the “principal business” of which is performing on a regular and continuing basis “management functions” for another organization (or group of related organizations);[10] and (2) such other organization.

IRS Publication 7005 (Revised April 2016)—Employee Benefit Plans Explanation No. 10 Affiliated Service Group, www.irs.gov/pub/irs-pdf/p7005.pdf, which is a checklist to assist IRS agents in 5300 414(m) determination letter requests (which was available prior to 2017), provided regarding § 414(m)(5), that: (i) whether an organization’s principal business is performing management functions on a regular and continuing basis for another organization is essentially a facts and circumstances question; (ii) factors to be considered could include the percentage of the organization’s gross receipts that are derived from performing management functions for the other organization and the amount of time individuals actually spend performing these functions; (iii) a sufficient period of time (e.g., more than one year) must be considered to ensure that the “regular and continuing basis” condition is met; and (iv) the particular activities and services that the organization provides for the other organization must also be considered in order to determine that these activities and services are in the nature of management functions.

Proposed regulations on § 414(m)(5), proposed in Aug. 27, 1987, 52 Fed. Reg. 32502, but later withdrawn April 27, 1993, 58 Fed. Reg. 25587, provided that “principal business” means that more than 50% of the organization’s gross receipts stem from the performance of management functions for the recipient organization. Withdrawn Proposed Regulation § l.414(m)-5(b).

The proposed regulations on § 414(m)(5) that was later withdrawn defined “management functions” broadly to include management activities and services involving the determination, implementation or supervision of: (i) daily business operations (e.g., production, sales, marketing, purchasing and advertising), (ii) personnel (e.g., staffing, training, supervising, hiring and firing), (iii) employee compensation and benefits (e.g., salaries and wages, paid vacations and holidays, life and health insurance and pensions), (iv) short-range and long-range business planning (e.g., product development, budgeting, financing, expansion of operations, and capital investment), (v) organization structure and ownership (e.g., corporate formation, stock issues, dividends and mergers and acquisitions), and (vi) any other management activity or service. Management activities and services also include professional services that relate to these activities. Withdrawn Prop. Treas. Reg. § 1.414(m)-5(c)(1), proposed in Aug. 27, 1987, 52 Fed. Reg. 32502, but later withdrawn under President Clinton’s Regulatory Burden Reduction Initiative April 27, 1993, 58 Fed. Reg. 25587. The management functions must be historically performed by employees. Id. Historically performed means that it is not unusual for employees of a particular business field determined as of September 3, 1983. Withdrawn Prop. Treas. Reg. § 1.414(m)-5(c)(2).

Although the reasons for the withdrawal were not stated, the assumption of many practitioners is that the proposed regulations were thought to be too stringent an interpretation of the statute and met with considerable negative reaction. However, commentators have indicated that these proposed regulations still may provide some indication of the intentions of the IRS with respect to management organizations affiliated service groups.

Example of Management Organization Affiliated Service Group

Geneva BioPharma Corp. and Aris Therapeutics constitute a controlled group of entities under Code § 414(b). Nexus Services and Horizon Management Group constitute an affiliated service group under Code § 414(m)(2). Assume Nexus Services or Horizon Management Group (or both) perform management functions and other services for Geneva BioPharma Corp. or Aris Therapeutics (or both), and the performance of these management functions or services satisfies the requirements of a principal business on a regular and continuing basis. Nexus Services and Horizon Management Group are treated as a single management organization, and Geneva BioPharma Corp. and Aris Therapeutics are treated as a single recipient organization for purposes of Code § 414(m)(5). Geneva BioPharma Corp., Aris Therapeutics, Nexus Services, and Horizon Management Group would constitute an affiliated service group under Code § 414(m)(5).

10. Conclusion

Practitioners must diligently analyze the relationships between entities whose principal business is the performance of services or management to determine if an affiliated service group exists, and the ramifications of such a finding. The affiliated service group rules are complex, and each case must be analyzed carefully.

[1] Note that Code § 269A which, if applicable, permits a reallocation of income, credits, exclusions, etc., between the personal service corporation and its employer owners. However, IRS Private Letter Ruling 8737001 (April 13, 1987) held that a sole shareholder professional corporation which was in a medical partnership was not formed or availed of for the principal purpose of avoiding federal income within the meaning of Code § 269A.

[2] Code § 414(m)(2)(B) would not encompass legitimately classified independent contractors.

[3] The same rule was provided in regulations proposed in 1987 under § 414(m)(5) but the § 414(m)(5) proposed regulations were withdrawn in 1993.

[4] Prop. Treas. Reg. § 1.414(m)-2(d) referred to the constructive ownership rules of Code § 267(c). However, these proposed regulations were issued before the constructive ownership reference in Code § 414(m)(6)((B) was changed by the Deficit Reduction Act Of 1984 from § 267(c) to § 318(a).

[5] See, e.g., Strauss and Shaw, Regs. Leave Questions on Affiliated-Service Groups, 53 Tax’n for Acct. 92 (Aug. 1994).

[6] See Danziger, Controlled Groups, Affiliated Service Groups, Leased Employees and Other Aggregation Rules Under Code Subsections 414(b), (C), (m), (n) and (0), C759 ALI-ABA 105(1992) that notes that the proposed regulations give little guidance as to what regularly performing services for or regularly associated with means. It poses the query as to what if two entities render no services to each other and their relationship is limited to routine referrals, does this referral relationship constitute regularly associated with providing services to third parties. It notes that one should consider the facts and circumstances.

[7] Note that while the § 414(m) regulations proposed in 1983 have never been finalized, various provisions of the proposed § 414(m) regulations have been cited in IRS private letter rulings and in the Internal Revenue Manual. Furthermore, Prop. Treas. Reg. § 414(m)-1(c) regarding a non-PC corporation not being an FSO for A-Org. affiliated service group purposes is specifically cited in IRS Publication 7005 (Revised June 2011) — Employee Benefit Plans Explanation No. 10 Affiliated Service Group.

[8] Code § 414(m)(2)(B) would not encompass independent contractors.

[9] These A-Org and B-Org flowcharts are from IRS Employee Plans Continuing Professional Education materials (Controlled and Affiliated Service Groups) (2004).

[10] “Related organizations” is defined by reference to Code § 144(a)(3). Code § 144(a)(3) states that persons are related if (A) the relationship between such persons would result in a disallowance of losses under Code §§ 267 or 707(b), or (B) such persons are members of the same controlled group of corporations (as defined in Code § 1563(a), except that “more than 50%” is used instead of “at least 80%”). Code § 267(b) defines related person as including: (i) members of the same family, (ii) an individual and a corporation more than 50% owned by the individual, and (iii) a corporation and a partnership if the same persons owns more than 50% of both the stock of the corporation and the capital or profits of the partnership, and certain similar relationships, and Code § 267(c) applies constructive ownership of stock rules. Code § 707(b) applies to a partnership and a greater than 50% owner of capital or profits therein, or to two partnerships where the same persons own more than 50% of capital or profits of each partnership. Code § 1563(a) is very similar to Code § 414(b) discussed above.